Wells Fargo – The Return of Enron?

Think your organization is Enron proof? Think again, or ask the CEO of Wells Fargo. Recently is came to light that some 5,300 employees of the financial giant engaged in massive fraudulent activities involving the falsification of documents, mishandling of customer accounts, and what essentially amounts to id theft. The use of another’s personal information to open accounts without their knowledge.

Now after Enron, Worldcom, Tyco, and oh yeah the great recession of 08, you would think certainly executive leaders paid the ultimate price right? Wrong! In fact, the top executive responsible for the division at the center of the storm was allowed to retire taking home more than $120 Million dollars. Certainly, someone was held accountable right, yep, the 5,300 low-level employees and supervisors directly involved in the fraud. It’s been reported that one of the fired employees actually called the compliance hotline to report the fraud before being fired. This is why ethics hotlines alone do not work.

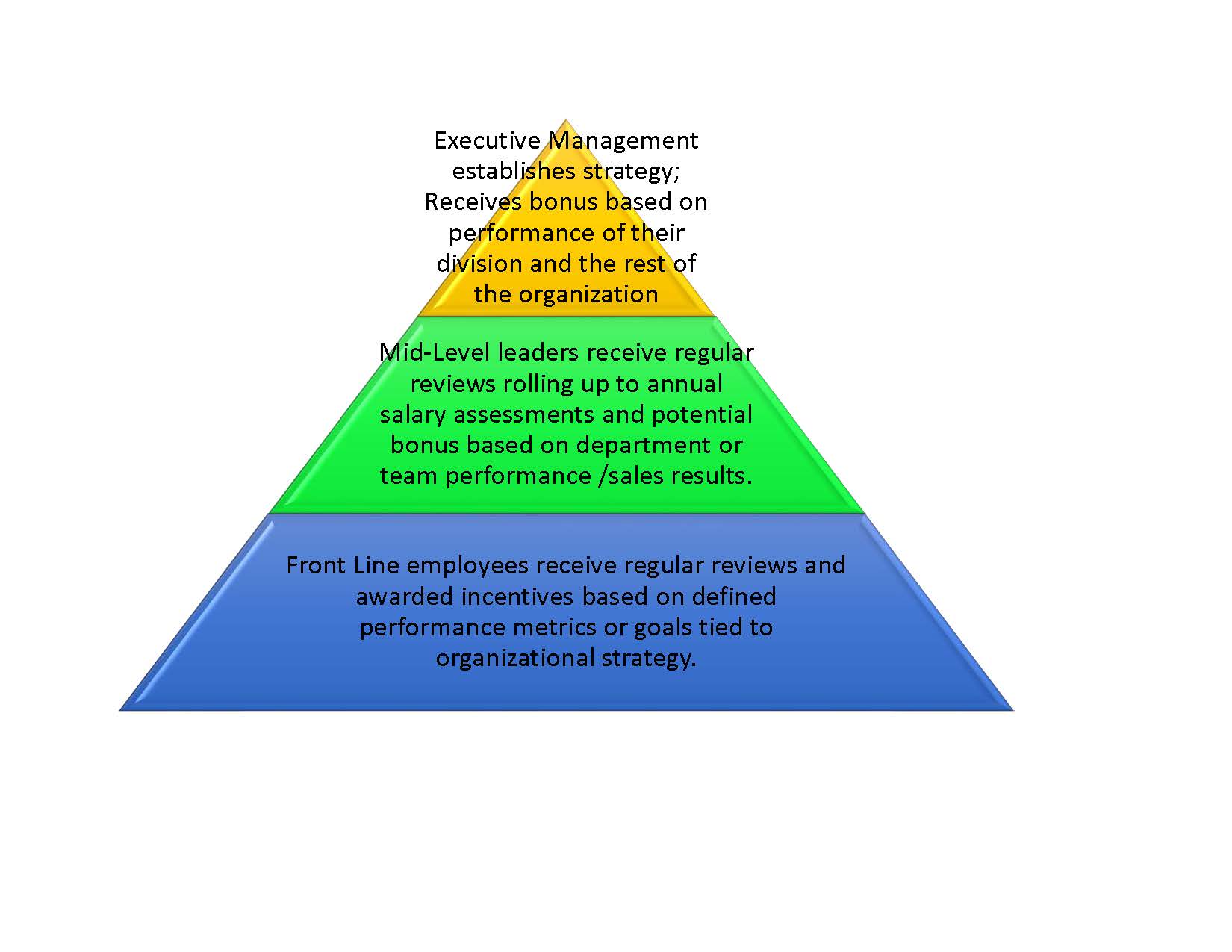

In most organizations the executive leadership establishes the strategy for the organization, for example, achieve 12% y/y growth in new accounts. The objective is communicated to mid-level leaders in the form of corporate strategy statements, and goal objectives. In turn, the specific targets are developed by the team down to the individual level. For example, a front line member may receive a goal of 35 new accounts per month. Achieving this goal could result in either monthly, quarterly or annual bonus. Obviously the more the goal is exceeded the higher the payout. This is a very common operating practice, and let me say properly managed, pay for performance is highly effective.While I have no knowledge of the specifics surrounding the compensation programs at Wells, the basics would most likely be something like this:

Culture Clash

In high performing customer and employee-centric cultures, there are organic protections against the creation of an Enron-like environment. Employees are invested and engaged in the mission of the organization, the customers best interest is at the heart of every decision. Measures are in place to ensure the proper checks and balances actively protecting the customer’s experience at every leg of the journey.

When the customer and the organization’s relationship with the customer are central to the core of operations, the customer is protected. Employees from the C-suite to the frontline understand and embrace their individual responsibility to protect the relationship with the customer, and that unethical acts are not tolerated at any level. This is more than an annual training event, stern language in the employee handbook, it is part of the organization’s DNA, and is celebrated, rewarded and enforced openly.

Is your organization Enron – Wells Fargo Proof?